It has now been just over a year since the pandemic wreaked havoc on the Australian economy. While this has undoubtedly been an incredibly tough period for many industries, this was not the case for the industrial property sector.

When the pandemic reshaped the Australian economy, the June quarter delivered the biggest ever uptake of industrial space. This was a direct chain reaction to the construction and manufacturing industries needing to secure more space in response to the growing need to hold more stock onshore. Since the pandemic disrupted the global supply chain, industries were required to have everything they needed onshore. They could no longer stick to their pre-pandemic supply chain timeline, and the product needed to be already onshore before selling it to consumers.

The e-commerce boom also helped record low vacancies across the board. They were then driven lower by Melbourne’s long lockdown period between July and November, and the introduction of government benefit packages, which is why Melbourne saw the highest portion of leasing activity through this time. With online activity still showing no sign of slowing even into mid-2021, new highs are expected to be hit within the industry throughout the rest of the year.

The gross take-up of industrial space over the past 12 months has continued to rise, with a total of 3.82 million square meters. This is a 59 percent increase on the 10-year average for 2.4 million square meters per annum. Melbourne saw the highest portion of leasing activity, equalling 38 percent of the national total. Alongside the Victorian capital, two other prominent capitals Sydney and Brisbane accounted for 90 percent of all the uptake nationally.

Naturally, with vacancy rates of industrial property hitting an all-time low, it created a flow of effect into the property sector. With limited industrial space available, rents are rising as businesses compete to land the perfect industrial areas.

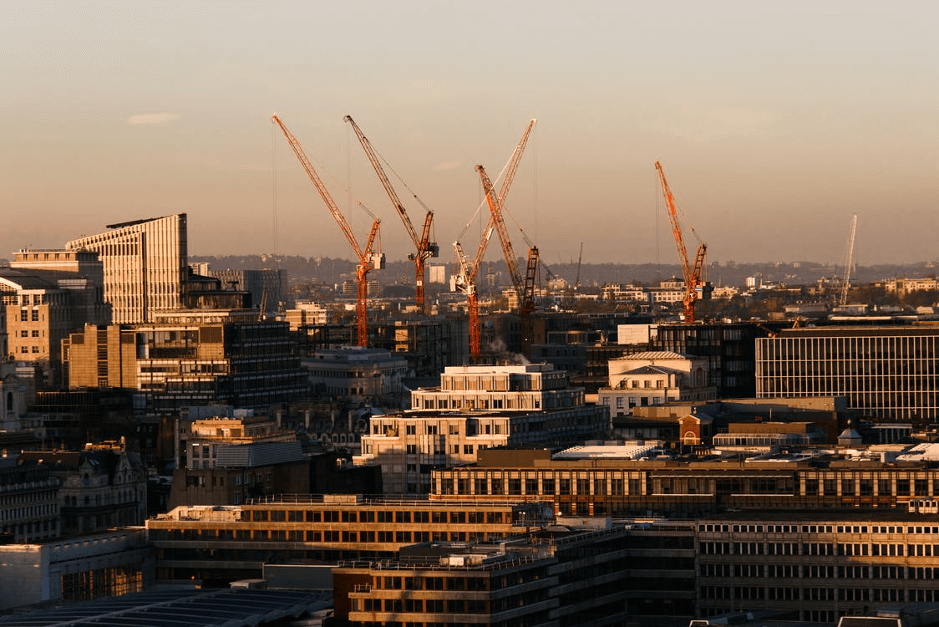

As a result, new developments are showing up across the country to keep up with industrial demand and provide suitable spaces for every business, whether that’s e-commerce, manufacturing, or construction. Over 800,000 square meters of space for industrial expansion are set to commence before the end of the next quarter.

So, now as empty sheds are a rarity and vacancy rates continue to plunge, you will need to ensure that you are in the hands of industrial property experts when searching for industrial space.

If you ask any real estate professional about the benefits of investing in industrial property, they will likely give you a monologue on how such properties are more beneficial than other types. There is certainly no economic uncertainty within the sector, despite financial hardship still being a prominent factor throughout 2021. Even with exciting new developments on the way, vacancy rates are still expected to remain low and continue the trend of stability throughout the industrial sector. With no hesitation for the future, keep your eye out for the forward-moving growth expected for the rest of the year.